Software is an integrated part of modern Accounts Payable. And whether you use a dedicated invoice handling software or a more extensive ERP system (like Microsoft Dynamics 365 Business Central) the way you handle invoices is most likely going to happen on your computer. And Accounts Payable Software is here to help.

There's a range of ways to handle invoices: from manually entering each invoices and making sure approvals are done face to face – or having a fully automated setup that utilizes workflows and AI or OCR to help ease the burden of trivial daily tasks in accounts payable. No matter the size of your company, there is solutions that can help automate processes.

Accounts Payable automation

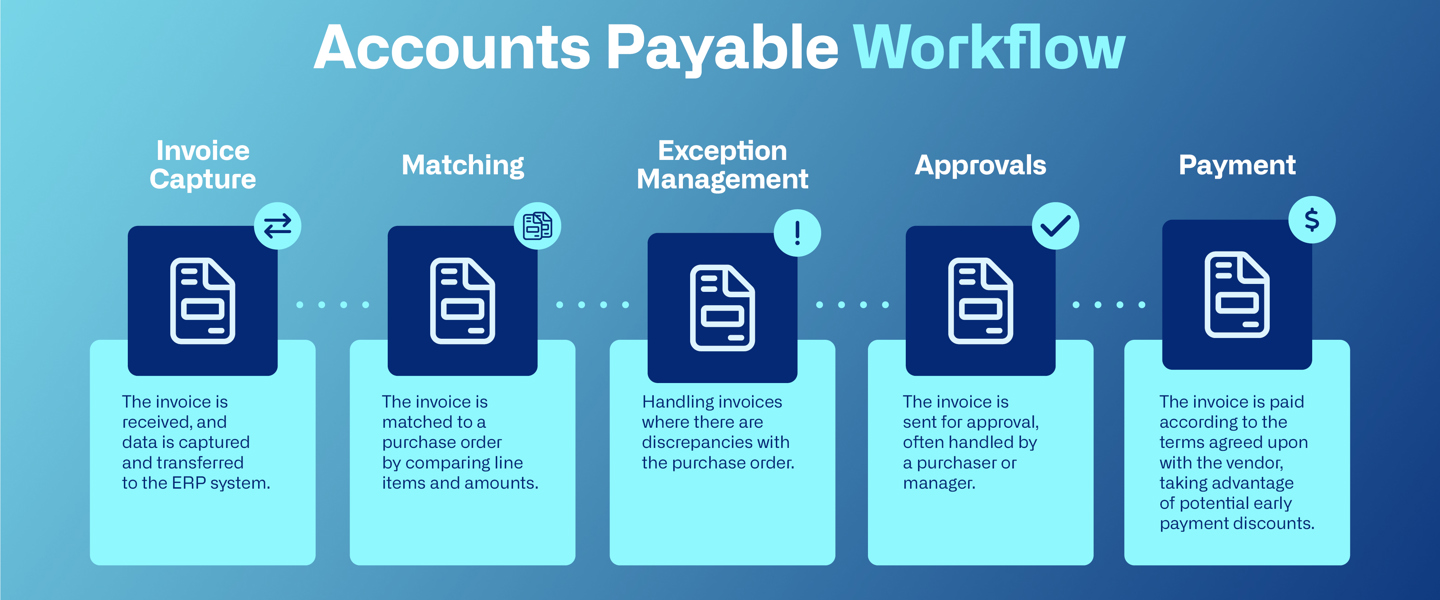

The best ERP systems will let you set up every part of the payment process as automated tasks handled in the background. Incoming invoices can be scanned, all payment information can transferred to the relevant fields with the help of AI or Optical Character Recognition - in the form of OCR invoice scanning - and approvals and payment terms can be set up based on vendor information, amounts, or type of purchase.

AP automation and the right software can free up large amounts of time in Accounts Payable that can be used to solve more serious issues and let small teams handle a growing number of invoices without adding more employees – thus saving both time and money.

Job titles in Accounts Payable

Job titles in Accounts Payable range from finance or accounting assistants to highly specialized roles depending on the size of the company. Each job role contribute to the efficient processing and solving of tasks and problems that arise from the daily operations. The job titles include:

- Accounts Payable Manager

- Accounts Payable Coordinator

- Accounting Assistant

- Accounts Payable Specialist

- Accounts Payable Clerk

What are the benefits of AP automation?

Automating the processes in the AP department has a large range of benefits, that will provide you with valuable improvements in all tasks.

Increased accuracy

Automation bolsters transaction accuracy by mitigating the chances of human mistakes, thereby reducing instances of payment discrepancies, including double payments or fraudulent transactions. Automated systems check invoice details against ERP systems early on, identifying potential payment issues promptly.

Better use of resources

Automation refines the invoicing and payment sequence, diminishing the time needed for approvals and boosting overall productivity. AP automation tools can seamlessly integrate with pre-existing financial frameworks, augmenting efficiency and ensuring a smooth exchange of data across platforms.

Better efficiency

Automation refines the invoicing and payment process, diminishing the time needed for approvals and boosting overall productivity. AP automation tools can seamlessly integrate with pre-existing financial frameworks, augmenting efficiency and ensuring a smooth exchange of data across platforms.

Cost efficiency

Implementing AP automation can drastically reduce the expenses associated with invoice handling, offering savings in both monetary terms and resource allocation. Automation alleviates labor costs by minimizing manual data entry and removes expenses related to document storage, mailing, and invoice creation, among others.

The financial benefit of AP Automation

Thinking about bringing an accounts payable automation system on board? It's smart to weigh up the return on investment (ROI) first. But working out the ROI for AP automation isn't always a walk in the park. Because it touches so many parts of your business, and the benefits really start to stack up as you ramp up the volume.

When you're crunching those ROI numbers for AP automation, remember to think about the whole picture. This includes the cash you'll save and the other perks that don't directly hit your wallet but still make a big difference.

The financial ROI of AP automation

Lots of factors impact the ROI figures when you're thinking about AP automation. It's not a one-size-fits-all situation. The digits will shift based on what industry you're in, how many invoices land in the inbox each month, and how much you're using right now to keep the process going.

Here are a few key things to keep in mind:

- You'll likely see a dip in how much you're spending on getting invoices processed.

- Fewer mistakes. Expect errors to go down, along with the losses they cause.

- More of your payments will hit their deadlines, keeping suppliers happy and maybe even boosting your rep.

- Time is money - and you will save more of it by by being more efficient.

- Getting early payment discounts becomes a whole lot easier.

- And, last but not least, you might not need as many hands on deck, which means savings on staffing costs too.

The non-financial aspects