Is your business ready for VAT in the Digital Age (ViDA)?

The digital economy has changed how we trade, send invoices, and report taxes. Because of this, the European Commission has introduced a new legislative package called VAT in the Digital Age (ViDA).

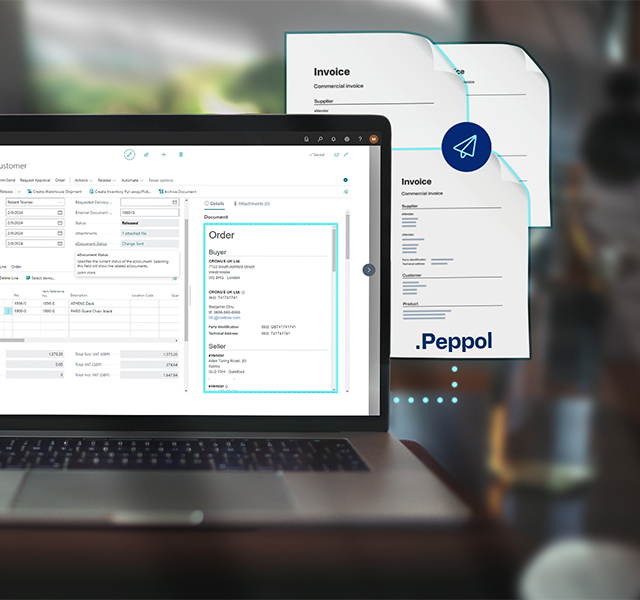

For businesses, VAT compliance is about to change dramatically. There will be a strong focus on e-invoicing, real-time reporting, and digital tools. But what does ViDA mean, and how will it affect you?

By the end of this guide, you'll understand how ViDA impacts your business and how to prepare for the changes. We’ll explain the law in simple terms, cover its three main pillars, and ensure you’re ready to adapt.